tax credit survey ssn

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Our WOTC tax credit screening can add bottom line savings by screening new hires for tax credit eligibility.

Usa Social Security Card Psd Template Ssn Psd Template Social Security Card Card Template Templates

The Social Security number will be verified through the Social Security Administration SSA Master Earnings file MEF.

. Write Applying for ITIN. So I guess I made a bad first impression on the phone. By screening hiring and retaining WOTC qualified employees your business may.

Employers will earn 25 if the employee works at least 120 hours and 40 if the employee works at least 400 hours. Application attached next to the SSN field. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP.

Get answers to your biggest company questions on Indeed. Thus the maximum tax credit is generally 2400. It asks for your SSN and if you are under 40.

Work Opportunity Tax Credit ServicesEmployee Retention Tax Credit ServicesResearch Development Tax Credit ServicesEmployment and Income Verification Services Our Solutions Work Opportunity Tax Credit Expect the technology service and performance that your company deserves. Its asking for social security numbers and all. A 25 rate applies to wages for individuals who perform fewer than 400 but at least 120 hours of service for the employer.

Ive filled out maybe a hundred different applications and this is the first time Ive come across this. I also thought that asking for a persons age was discriminatory. Big companies want the tax credit and it might be a determining factor in selecting one applicant over another.

The WOTC program is designed to promote hiring of individuals within target groups who may face challenges securing employment due to limited skills or work experience. You must earn 6040 to get the maximum four credits for the year. During your lifetime you might earn more credits than the minimum number you need to be eligible for benefits.

Which would not be a problem with me but requesting that I take a survey which asks for my SSN at this level of the application process really doesnt give me a. These extra credits do not increase your benefit amount. Its a required field on the 2nd stage of an application before doing an interview.

You can earn a maximum of four credits for any year. Asking for the social security number on an application is legal in most states but it is an extremely bad practice. You must earn a certain number of credits to qualify for Social Security benefits.

I dont feel safe to provide any of those information when Im just an applicant from US. Performs at least 400 hours of services for that employer. Theyre asking for my ssn for a tax credit survey.

Maybe 300-500 or whatever with a deposit. Posted by 1 year ago. Once things get straightened out if you have a bank account you can generally open a secured credit line with the bank.

Doesnt seem like much but if youre just starting or trying to rebuild credit this might be the way to go. 1 day agoFor this year the child tax credit has reverted back to 2000 per child and phases in at 15 of earnings over 2500. Take the survey answering questions as needed.

I dont just give anyone my SSN unless I am hired for a job or for credit. Do not attempt to e-file your return. Yes we can do that.

Contact TCC TCC delivers tax incentive and human resources technology-enabled services specializing in solutions for the Work Opportunity Tax Credit WOTC income and employment verification research development tax credits sales and use tax incentives and other federal and state tax incentives. The amount needed for a credit in 2022 is 1510. The tax credit itself is equal to 25 or 40 of a new employees first-year wages up to the maximum for the target group to which the employee belongs.

The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. So if it doesnt work out next time I know. From the research Ive done its apparently used to see if I would gain the employer a tax credit.

Hiring certain qualified veterans for instance may result in a credit of. You have every right to be protective of your SSN though. Social Security Card Center Visitor Survey - Conducted by mail with a random sample of customers who visited any of the Social Security Card Centers during a 4-week period.

Complete IRS Form W-7. Im filling out an online job application chilis. You can possibly claim a.

Print the tax returns and cross off the 999-88-9999 from the SSN field. Yeah that probably wasnt a good question since they directed you to do it. Learn more about WOTC COVID-19 Employee.

In FY 2018 we began conducting the survey biennially. Posted May 31 2017. The number of credits you need depends on your age when you.

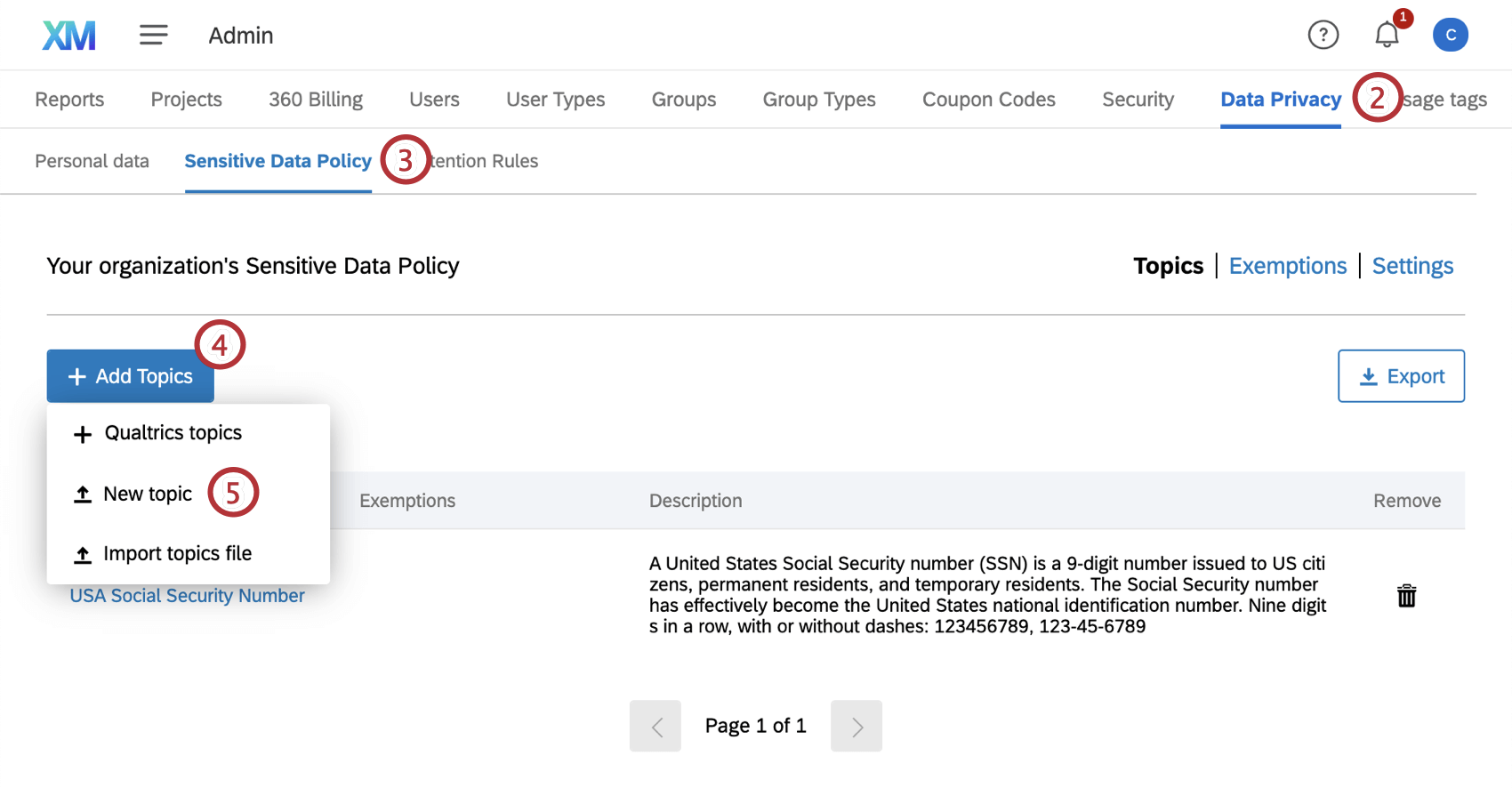

Employers can verify citizenship through a tax credit survey. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid. When you finish the survey the system checks whether the employer can receive tax credits.

Madhatters4 9K opinions shared on Other topic. In 2022 you earn one Social Security or Medicare credit for every 1510 in covered earnings each year. They DOL has a handy WOTC Calculator to see how much your business can earn.

Submitting SSN for Tax Credit Screening on application. In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. Refunds are capped at.

Complete your federal and state tax returns using the number 999-88-9999 in place of a Social Security Number. Up to 24000 in wages may be taken into account in determining the WOTC for certain qualified veterans. We introduced this survey in FY 2011.

You may need to download and electronically sign forms as part of this task. The amount needed to earn one credit increases automatically each year when average wages increase. The website on the search bar is wotcgsey.

Upload any documents needed to complete this task. However when the worker already has a TIN taxpayer identification number or Social Security number the employer doesnt need to verify citizenship. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit.

So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. Some states prohibit private employers from collecting this information for fear of identity theft It is not recommended that you provide this information on. The website on the search bar is wotcgsey.

Theyre asking for my ssn for a tax credit survey. The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are based on age. Message about your eligibility displays.

As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher.

Free 8 Sample Social Security Verification Forms In Pdf Ms Word

The Social Security On The Front Of Your Social Security Card Is Assigned To The Debtor Or S In 2021 How To Get Money Social Security Card Archaeological Discoveries

How Can I Get A Iiti Number For Free And Publish Books On Amazon Kdp Account

Social Security Number Ssn On Job Application Ihire

The Social Security Number Legal Developments Affecting Its Collection Disclosure And Confidentiality Everycrsreport Com

Pdf A Whole New World Income Tax Considerations Of The Bitcoin Economy

Social Media Marketing Contract Template Beautiful Mission Agreement Template Free Sample Example Format Contract Template Marketing Consultant Work For Hire

Blue Payslip Design 1 Digital Only Copy Year Of Dates Templates Document Templates

Buy Real Passport I D Cards Drivers License Ielts Certificate And Ssn Card Online Contact Us On Wh Drivers License Ca Drivers License Id Card Template

Irs Issues Reminder About Tax Debts Act Now To Avoid Losing Your Passport Passport Online Expired Passport Passport

Can I Get A Job With My W 2 Being That The Form Provides My Social Security Number As I Do Not Currently Have A Copy Of The Original Social Security Card

Asking For Social Security Numbers On Job Applications Goodhire

Fresh New Customer Form Template Free Audiopinions Document Template Agenda Template Meeting Agenda Template Templates

Pdf A Greek Privacy Tragedy The Introduction Of Social Security Numbers In Greece

Eliminating The Use Of Your Social Security Number In Aes

Match Ssn And Last Name 7 Ssn Lookup And Verification Services